Loanable Funds Market Demand Curve

Loanable Funds Market Demand Curve. Let's start with the demand for loanable funds there's a couple of ways that the demand for loanable funds curve could shift maybe all of a sudden people see new business opportunities asteroid mining is becoming a thing and so people. The curve / stands for the investment demand for savings. Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and d and s for loanable funds will be at equilibrium at the higher nominal interest rate. The market for loanable funds consists of two actors, those loaning the money (savings from households like us) and those the second curve represents those borrowing loanable funds and is called the demand for loanable funds line. The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan. 6 e equilibrium loanable funds demand curve, d loanable funds supply curve, s equilibrium in the loanable funds market interest rate, r quantity of loanable funds rere qeqe. Curves of supply and curves of demand are responsible in determining the real interest rate. Loanable funds market supply of loanable funds loanable funds come from three places 1. The loanable funds' demand is determined by the interest rate. So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things.

What happens in the loanable funds market when the government runs deficit? The market for loanable funds is where borrowers and lenders get together. What is meant by the term crowding out? The market for loanable funds consists of two actors, those loaning the money (savings from households like us) and those the second curve represents those borrowing loanable funds and is called the demand for loanable funds line. 6 e equilibrium loanable funds demand curve, d loanable funds supply curve, s equilibrium in the loanable funds market interest rate, r quantity of loanable funds rere qeqe.

So, the interest rate fall and rises.

The downward sloping investment curve is derived on standard neoclassical marginalist principles. 6 e equilibrium loanable funds demand curve, d loanable funds supply curve, s equilibrium in the loanable funds market interest rate, r quantity of loanable funds rere qeqe. In these capital markets, firms are typically demanders of capital, while households are typically suppliers of capital. So, the interest rate fall and rises. In this lesson on loanable funds market, you will learn the following: As with other markets, there is a supply curve and a demand curve. The market for loanable funds is where borrowers and lenders get together. The demand curve for loanable funds is downward sloping, indicating that at lower interest rates. For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. The same four groups demand and supply loanable funds, so it is important to understand the economic behavior depicted by the demand and supply curves for loanable funds. Loanable funds market supply of loanable funds loanable funds come from three places 1. This video explains the intuition behind shifting the demand curve for loanable funds.

In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved in the. The market for loanable funds consists of two actors, those loaning the money (savings from households like us) and those the second curve represents those borrowing loanable funds and is called the demand for loanable funds line. With demand for capital constant, interest rates will rise. The loanable funds' demand is determined by the interest rate. People who are interested in borrowing money are more. The loanable funds market reaches equilibrium when demand equals supply, determining the amount of loanable funds and the economy's interest rate. The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital. The demand for loanable funds is the relationship between the quantity of loanable funds demanded and the real interest rate when all other influences on borrowing plans remain the same. Anything that increases the amount of investment that households and.

Anything that increases the amount of investment that households and.

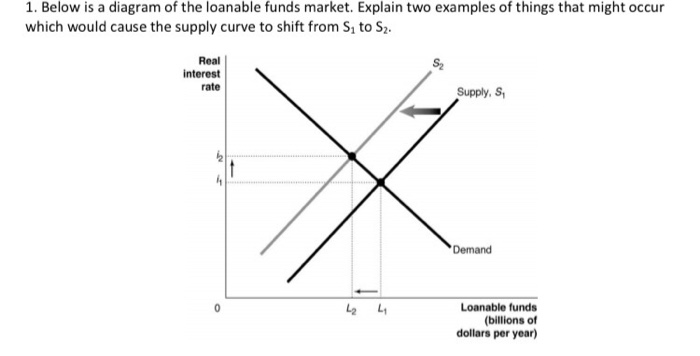

When the supply of loanable funds increases the supply curve of loanable funds curve shifts rightward. In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved in the. What happens in the loanable funds market when the government runs deficit? 6 e equilibrium loanable funds demand curve, d loanable funds supply curve, s equilibrium in the loanable funds market interest rate, r quantity of loanable funds rere qeqe. The demand for loanable funds is determined by the amount that consumers and firms desire to invest. So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things. The curve / stands for the investment demand for savings. Let's start with the demand for loanable funds there's a couple of ways that the demand for loanable funds curve could shift maybe all of a sudden people see new business opportunities asteroid mining is becoming a thing and so people. Loanable funds market •nominal v. The demand for loanable funds is considered as under: The determinants of the supply of loanable funds (national savings) and demand for loanable funds (domestic investment + net foreign investment).

The same four groups demand and supply loanable funds, so it is important to understand the economic behavior depicted by the demand and supply curves for loanable funds. Loanable funds market supply of loanable funds loanable funds come from three places 1. What entities demand money from the loanable funds market?

This is the currently selected item.

A government spending cut and a decrease in government borrowing as a result of favorable decrease in budget deficit will shift the supply curve of bond markets to the left leading to higher bond prices and. Stock exchanges, investment banks, mutual funds firms, and commercial banks. It slopes downward to represent an inverse the diagram also, elucidates the wicksellian distinction, between the natural rate of interest and the market rate of interest. The equilibrium interest rate is determined by the intersection of the demand and supply curves in the market for loanable funds. Loanable funds market supply of loanable funds loanable funds come from three places 1. This is the currently selected item. What happens in the loanable funds market when the government runs deficit? People who are interested in borrowing money are more. In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved in the. The downward sloping investment curve is derived on standard neoclassical marginalist principles. So, the interest rate fall and rises. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. The determinants of the supply of loanable funds (national savings) and demand for loanable funds (domestic investment + net foreign investment). In economics, the loanable funds doctrine is a theory of the market interest rate.

What entities demand money from the loanable funds market? loanable funds curve. International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Curves of supply and curves of demand are responsible in determining the real interest rate.

The demand curve for loanable funds is downward sloping, indicating that at lower interest rates.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com The market for foreign currency exchange.

If we plot it on a graph, the demand curve for.

Source: media.cheggcdn.com

Source: media.cheggcdn.com The same four groups demand and supply loanable funds, so it is important to understand the economic behavior depicted by the demand and supply curves for loanable funds.

Source: i0.wp.com

Source: i0.wp.com International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com It is true that both supply and demand gets fluctuate in the loanable fund market.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org In this lesson on loanable funds market, you will learn the following:

The two have an inverse relationship.

Source: i1.wp.com

Source: i1.wp.com What happens in the loanable funds market when the government runs deficit?

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: media.cheggcdn.com

Source: media.cheggcdn.com Loanable funds market •nominal v.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com The loanable funds' demand is determined by the interest rate.

Source: i1.wp.com

Source: i1.wp.com The equilibrium interest rate is determined by the intersection of the demand and supply curves in the market for loanable funds.

Real interest rate •rate of return •the laws of supply and demand explain the behavior of savers and d and s for loanable funds will be at equilibrium at the higher nominal interest rate.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk A government spending cut and a decrease in government borrowing as a result of favorable decrease in budget deficit will shift the supply curve of bond markets to the left leading to higher bond prices and.

Source: study.com

Source: study.com With demand for capital constant, interest rates will rise.

Source: welkerswikinomics.com

Source: welkerswikinomics.com The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan.

So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things.

Source: i0.wp.com

Source: i0.wp.com • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk International borrowing supply of loanable funds curve i 6% 4% 40 60 lf equilibrium in the loanable funds market shifts in demand for.

Source: sbhshgovapmacro.files.wordpress.com

Source: sbhshgovapmacro.files.wordpress.com The same four groups demand and supply loanable funds, so it is important to understand the economic behavior depicted by the demand and supply curves for loanable funds.

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com If we plot it on a graph, the demand curve for.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net This is the currently selected item.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

The market for loanable funds is where borrowers and lenders get together.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com The curve / stands for the investment demand for savings.

Source: welkerswikinomics.com

Source: welkerswikinomics.com In these capital markets, firms are typically demanders of capital, while households are typically suppliers of capital.

Source: 0901.static.prezi.com

Source: 0901.static.prezi.com • the loanable funds market includes:

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Loanable funds market •nominal v.

Source: penpoin.com

Source: penpoin.com The aggregate loanable fund supply curve sl also slopes upwards to the right showing the greater supply of loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of market rate of interest is that which equates the supply of and demand for loanable funds.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com The aggregate loanable fund supply curve sl also slopes upwards to the right showing the greater supply of loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of market rate of interest is that which equates the supply of and demand for loanable funds.

Source: quizlet.com

Source: quizlet.com The two have an inverse relationship.

Posting Komentar untuk "Loanable Funds Market Demand Curve"